TechTarget News

News from TechTarget's global network of independent journalists. Stay current with the latest news stories. Browse thousands of articles covering hundreds of focused tech and business topics available on TechTarget's platform.Latest News

-

16 May 2025

Channel catch-up: News in brief

By Simon QuickeDevelopments this week at Ignition Technologies, Phoenix Software, Westcon-Comstor and Utelogy

-

16 May 2025

5GAA claims first-ever satellite, 5G-V2X direct vehicle connectivity

By Joe O’HalloranLeading car manufacturers demonstrate what is said to be a world-first for emergency messaging and hazard warnings showing the ability for vehicles to connect over non-terrestrial networks, complementing terrestrial 4G and 5G

-

16 May 2025

RSAC 2025: AI everywhere, trust nowhere

We're at an inflection point. AI is changing the game, but the rules haven't caught up.

- Latest news from around the world

All News from the past 365 days

-

16 May 2025

ITS claims UK first for 50G-PON business trial

By Joe O’HalloranWhat is described as ‘pioneering’ test with Lancashire-based technology group said to have shown early demand for next-generation fibre speeds through passive optical network

-

16 May 2025

No workaround leads to more pain for VMware users

By Cliff SaranThere are patches for the latest batch of security alerts from Broadcom, but VMware users on perpetual licences may not have access

-

16 May 2025

Cisco prepares partners for its 360 partner programme

By Simon QuickeHalfway through the time between announcement and launch of the fresh channel programme, Cisco’s UK channel boss is busy supporting partners through the transition

-

16 May 2025

Security tests reveal serious vulnerability in government’s One Login digital ID system

By Bryan GlickA ‘red teaming’ exercise to simulate cyber attacks on the government’s flagship digital identity system has found that One Login can be compromised without detection

-

16 May 2025

BT to bring gigabit broadband to hard-to-reach Swansea Bay areas

By Joe O’HalloranUK’s leading comms provider inks £10m contract to deliver full-fibre to nearly 1,800 sites across the south coast of Wales, bridging connectivity gaps in Pembrokeshire, Swansea, Neath Port Talbot and Carmarthenshire

-

16 May 2025

The Security Interviews: David Faugno, 1Password

By Peter Ray AllisonDavid Faugno, co-CEO of 1Password, discusses how his background led to him joining the company and why maintaining profitability is a key factor in overcoming the challenges of switching markets.

-

16 May 2025

Com4 selects Nokia 5G standalone core to power global IoT

By Joe O’HalloranNorwegian managed internet of things connectivity provider installs 5G Standalone Core to power global IoT services with a flexible architecture to enable company to meet demand for connected devices

-

16 May 2025

Kissflow finds its place in low-code market

By Aaron TanThe supplier of low-code software development tools that cater to both citizen developers and IT professionals is experiencing rapid growth in Southeast Asia where it has been doubling its revenue over the past four years

-

15 May 2025

Together AI acquires startup to improve data quality

By Esther ShittuThe startup has a family of models for data tasks. The acquisition adds complementary capabilities to improve AI model quality.

-

15 May 2025

Proposed U.S. budget cuts raise fears about tech innovation

By Makenzie HollandPresident Donald Trump's proposed FY 2026 budget slashes funding for federal agencies, including NSF and NIST, which support tech research and innovation in the U.S.

-

15 May 2025

NHS asks suppliers to sign up to cyber covenant

By Alex ScroxtonNHS digital and security leaders call on their suppliers to commit to a cyber security charter as the health service works to improve its resilience in the face of growing threat levels

-

15 May 2025

Salesforce acquisition of Convergence adds Agentforce talent

By Don FluckingerSalesforce beefs up its Agentforce engineering corps, leadership.

-

15 May 2025

Qlik evolves to keep up with latest AI, analytics trends

By Eric AvidonThe longtime BI vendor continues to expand beyond its historical base to keep current with what's happening in GenAI and agentic development, analytics, and data management.

-

15 May 2025

House committee pushes through Medicaid work requirements

By Sara HeathThe legislative language enacting Medicaid work requirements awaits full discussion on the House floor.

-

15 May 2025

New remote patient monitoring advocacy group launches

By Anuja VaidyaThe new Remote Monitoring Leadership Council aims to expand RPM access, adoption and policy through advocacy and data sharing.

-

15 May 2025

GSMA calls for governments to prioritise affordable mobile spectrum

By Joe O’HalloranGlobal Spectrum Pricing Report from mobile trade association finds spectrum costs have risen sharply, increasing the cost burden on operators and constraining critical network investment

-

15 May 2025

How close is quantum computing to commercial reality?

By Cliff SaranAt a recent event, experts explored the progress towards logical qubits and how these will be applied to empower business IT

-

15 May 2025

Innovation team expanding ADP horizons

By Simon QuickeManaged service player keen to identify relationships where it can add value with its expertise in disaster recovery and data protection

-

15 May 2025

Is there implicit bias in patient clinical notes?

By Sara HeathResearchers found evidence of implicit bias in clinical notes, particularly with variable use of positive negative language used for patients of difference races.

- 15 May 2025

-

15 May 2025

Lancashire Police extends use of Pronto tech for faster, more effective response

By Joe O’HalloranNorthwest of England force unveils next-gen approach to policing with voice-activated systems in vehicles and livestream body cameras that give the control room real-time visibility of incidents

-

15 May 2025

SonicWall keeps focus on MSP channel

By Simon QuickeSecurity player continues to roll out products and services for its partners as it identifies further growth fueled by customer demand for zero-trust solutions

-

15 May 2025

Government starts private sector engagement on digital ID and Gov.uk Wallet

By Lis EvenstadFollowing concerns from the digital identity industry that Gov.uk Wallet would dominate the market, the government has offered private sector providers a ‘critical role’ in its future, as it revealed further details on the wallet

-

15 May 2025

Myriota and ETSI team to boost NTN IoT satellite comms standardisation

By Joe O’HalloranGlobal IoT-optimised satellite connectivity provider becomes associate member of leading communications standards body to boost delivery to mobile devices

-

15 May 2025

Smart ball analytics proves value in rugby

By Brian McKennaWelsh professional rugby player Dan Biggar gives his thoughts on the role of data analytics in his sport, at an event where the Sportable smart ball was demonstrated

-

15 May 2025

Post Office scandal inquiry to publish first findings this summer

By Karl FlindersInquiry announces that findings on compensation and human impact will be presented in the next few months

-

14 May 2025

Scattered Spider retail attacks spreading to US, says Google

By Alex ScroxtonGoogle’s threat intel analysts are aware of a number of in-progress cyber attacks against US retailers linked to the same Scattered Spider gang that supposedly attacked M&S and Co-op in the UK

-

14 May 2025

London Fire Brigade improves emergency response network

By Joe O’HalloranUK’s largest fire service turns to advanced comms tech – including real-time data analytics and social media integration – to make it easier and quicker for the public to contact it and improve its response to emergencies across UK capital

-

14 May 2025

Alteryx One launch aims to unify, simplify vendor's platform

By Eric AvidonThe updated version of the data integration vendor's platform aims to make it easier to prepare data for AI and analytics, while new GenAI tools further simplify data preparation.

-

14 May 2025

Fibre, 5G continue to expand global footprint

By Joe O’HalloranCore ‘future-proof’ communications technologies are steadily expanding their reach as wireless applications gain ground in key territories

-

14 May 2025

Enisa launches European vulnerability database

By Alex ScroxtonThe EU’s new vulnerability database is designed to offer a broader, more transparent source of information on new cyber vulnerabilities

-

14 May 2025

Why we must reform the Computer Misuse Act: A cyber pro speaks out

By Alex ScroxtonBritain’s outdated hacking laws are leaving the UK’s cyber practitioners hamstrung and afraid. Security professional Simon Whittaker reveals how he nearly ran afoul of the Computer Misuse Act, and why he’s speaking out for reform

-

14 May 2025

Openreach connects first customers under Project Gigabit partnership

By Joe O’HalloranUK’s leading broadband provider reveals initial customers in hardest-to-reach communities gaining gigabit access as part of partnership with government’s £5bn deployment scheme

-

14 May 2025

Databricks adds Postgres database with $1B Neon acquisition

By Eric AvidonThe vendor's latest purchase comes six months after it raised $10B in funding. By adding PostgreSQL database capabilities, it aims to better enable users to build AI applications.

-

14 May 2025

Ekco unveils fresh CEO as Evolve IP extends ecosystem

By Simon QuickeDevelopments in the managed service world as an experienced channel executive takes up a fresh leadership role and a partnership is struck to provide an MSP with more telephony options

-

14 May 2025

Boomi launches agentic AI development tools, support for MCP

By Eric AvidonThe longtime iPaaS vendor continues to expand beyond its historical base with the additions of Agentstudio, agents that simplify integration and change data capture capabilities.

-

14 May 2025

HPE adds Morpheus Data to KVM hypervisor for enterprises

By Tim McCarthyA KVM hypervisor by Hewlett-Packard Enterprise evolves with technology and capabilities from Morpheus Data, an HPE acquisition, as the company also releases other products.

-

14 May 2025

Twilio updates conversational intelligence, expands CDP

By Don FluckingerTwilio integrates its CDP and communications platform more closely.

-

14 May 2025

Informatica to build agents, foster agentic AI development

By Eric AvidonWith agents now a major trend in data management, the vendor plans to join the fray by developing agentic capabilities and providing customers with the tools to do the same.

-

14 May 2025

Qlik unveils agentic AI capabilities, launches lakehouse

By Eric AvidonAn insight generation tool and capabilities that unlock unstructured data are among the longtime analytics vendor's latest features, while a data lakehouse represents expansion.

-

14 May 2025

UK government outlines plan to surveil migrants with eVisa data

By Sebastian Klovig SkeltonElectronic visa data and biometric technologies will be used by the UK’s immigration enforcement authorities to surveil migrants living in the country and to ‘tighten control of the border’, attracting strong criticism from migrant support groups

-

14 May 2025

Exertis steps up DEI commitment

By Simon QuickeDistributor increases number of support groups available for staff and backs DEI efforts with a board appointment

-

14 May 2025

BBVA creates ChatGPT Store and expands use of the GenAI tool

By Karl FlindersData reveals that bank employees are saving an average of almost three hours every week by using ChatGPT

-

14 May 2025

Humphrey AI tool powers Scottish Parliament consultation

By Cliff SaranAI-powered Consult tool has helped the Scottish Parliament to organise feedback from a public consultation into themes

-

14 May 2025

New security paradigm needed for IT/OT convergence

By Aaron TanIndustry leaders and policymakers highlight growing cyber threats from the integration of IT and operational technology systems, calling for collaboration and regulatory frameworks to protect critical systems, among other measures

-

14 May 2025

Australian public cloud spending to hit A$26.6bn in 2025

By Aaron TanGartner forecasts strong growth in cloud infrastructure and platform services even as Australian organisations grapple with scaling AI initiatives and managing rising cloud expenditure

-

13 May 2025

Microsoft tackles 5 Windows zero-days on May Patch Tuesday

By Tom WalatThe company addresses 72 unique CVEs this month, but several AI features bundled in a larger-than-usual update could bog down some networks.

-

13 May 2025

Nvidia, AMD, others tout AI partnerships with Saudi Arabia

By Esther ShittuThe U.S. tech involvement follows a long-term plan for the country to become an AI hub by 2030. Vendors get access to energy resources, and Saudi Arabia benefits from AI chips.

-

13 May 2025

UKRI must do more to drive innovation agenda and avoid fraud

By Cliff SaranUKRI’s funding of research and innovation to support the government’s growth strategy has room for improvement

-

13 May 2025

Bill aims to restore appropriate use criteria for imaging

By Jill McKeonThe Radiology Outpatient Ordering Transmission (ROOT) Act aims to modernize Medicare's imaging oversight process and bring back its appropriate use criteria program.

-

13 May 2025

May Patch Tuesday brings five exploited zero-days to fix

By Alex ScroxtonMicrosoft fixes five exploited, and two publicly disclosed, zero-days in the fifth Patch Tuesday update of 2025

-

13 May 2025

How AI can aid healthcare in digital identity verification

By Jill McKeonHealthcare organizations can use AI to defend against cyberthreat actors who use AI, especially in the areas of digital identity verification and social engineering.

-

13 May 2025

Automation Anywhere adds reasoning to agentic AI platform

By Esther ShittuThe robotic process automation vendor's agentic process automation platform now has a reasoning engine that can understand enterprise context and help with agentic orchestration.

-

13 May 2025

AI copyright suits to be affected by Copyright Office stance

By Makenzie HollandFederal report findings could weaken GenAI vendors' fair use positions in copyright suits.

-

13 May 2025

Surrey Search & Rescue taps Ericsson and UK Connect for critical connectivity

By Joe O’HalloranAdvanced connectivity solution that includes vehicle router and ruggedised devices deployed under SARNET initiative helps search and rescue teams respond faster, improving survival outcomes

-

13 May 2025

M&S forces customer password resets after data breach

By Alex ScroxtonM&S is instructing all of its customers to change their account passwords after a significant amount of data was stolen in a DragonForce ransomware attack

-

13 May 2025

KDDI, DriveNets team to accelerate open network architecture

By Joe O’HalloranStrategic partner to see leading carrier and software-based network services provider promote openness, disaggregation and innovation from the core network to the edge and aggregation layers

-

13 May 2025

Athenahealth says open ecosystem is core to EHR integration

By Brian T. HorowitzIn May Suki became the first ambient AI partner generally available across Athenahealth’s network, but the EHR provider said the key to interoperability is offering several options.

-

13 May 2025

UnitedHealth CEO Andrew Witty steps down

By Jacqueline LaPointeUnitedHealth Group announced the appointment of Stephen J. Hemsley as the company's CEO after Andrew Witty stepped down due to personal reasons.

-

13 May 2025

Sophos rolls out MSP Elevate

By Simon QuickeProgramme for managed service providers aims to support those committed to delivering growth

-

13 May 2025

AWS Marketplace channel partners rev software, service sales

By John MoorePartners are building a new route to market on AWS Marketplace. One has surpassed $1 billion in total sales and another expects to soon generate half its revenue there.

-

13 May 2025

USAA takes an 'experiment and see' approach with AI

By Esther ShittuThe financial services company experiments with different models and AI tools and technologies. It uses AI technology both internally and externally.

-

13 May 2025

HP expands refurbished PC scheme to cover the UK

By Simon QuickeHP provides a greener option for partners to pitch to customers concerned about sustainability, as well as budgets

-

13 May 2025

O2 upgrades Wembley Stadium connectivity

By Joe O’HalloranUpgrade around major UK sporting arena to see fans gaining access to dedicated distributed antenna system-based 5G standalone network inside the stadium, in addition to small cells and upgraded masts in surrounding area

-

13 May 2025

Private cellular business deployments to reach more than 7,000 by 2030

By Joe O’HalloranResearch finds enhanced security features and neutral host deployments will be central to expediting growth across all sectors for key sector of mobile industry

-

13 May 2025

Controversial Post Office Horizon system could stay until 2033

By Karl FlindersPost Office seeks off-the-shelf Horizon replacement as part of £492m tender that includes ongoing support for Horizon up to 2033

-

13 May 2025

Bytes breaks through GII £2bn barrier

By Simon QuickeChannel player Bytes shares FY numbers that underline its successful ability to emerge strongly through a challenging market

-

13 May 2025

Gov.uk One Login loses certification for digital identity trust framework

By Bryan GlickThe government’s flagship digital identity system has lost its certification against the government’s own digital identity system trust framework

-

13 May 2025

NHS trust cloud plans hampered by Trump tariff uncertainty

Essex NHS wants to move some capacity to the Nutanix cloud, but can’t be certain prices will hold between product selection and when procurement plans gain approval

-

13 May 2025

Evidence reveals Post Office scandal victims short-changed in compensation payouts

By Karl FlindersSubpostmasters who appealed compensation payments have significantly increased ‘worryingly undervalued’ settlements

-

13 May 2025

Australian data breaches hit record high in 2024

By Aaron TanMore than 1,100 data breaches were reported in Australia last year, a 25% jump from 2023, prompting calls for stronger security measures across businesses and government agencies

-

12 May 2025

Nokia looks to light up in-building enterprise connectivity with Aurelis

By Joe O’HalloranFibre-based LAN solution designed to deliver simple, reliable and future-proof local area connectivity for enterprises, using up to 70% less cabling and 40% less power than copper-based technologies

-

12 May 2025

Wi-Fi 7 trials show ‘significant’ performance gains in enterprise environments

By Joe O’HalloranWireless technology consortium reveals industry trials of latest Wi-Fi standard in enterprise scenarios revealing increased throughput, lower latency and enhanced efficiency for high-demand applications

-

12 May 2025

Channel moves: Who’s gone where?

By Simon QuickeMoves of note this week at WatchGuard, Quantum Trilogy, Delinea and Nexer Enterprise Applications

-

12 May 2025

Contempt order worsens Apple's antitrust woes

By Makenzie HollandA federal judge found Apple to be in contempt of an injunction ordering the company to make access to alternative payment options in the company's App Store easier.

-

12 May 2025

2025 MedTech Breakthrough winners for healthcare payments

By Jacqueline LaPointeWaystar, Candid Health and TrustCommerce are among the winners of the 2025 MedTech Breakthrough Awards in the healthcare payments category.

-

12 May 2025

Systemic gaps hinder cell and gene therapy adoption, access

By Alivia Kaylor, MScOver 200 cell and gene therapy treatments could be FDA-approved by 2030, but adoption could lag due to structural barriers, limited infrastructure and centralized access.

-

12 May 2025

Italian bank signs 10-year deal with Google Cloud

By Karl FlindersUniCredit will transform operations through cloud, AI and data analytics technologies from Google Cloud

-

12 May 2025

Limited payer prescription drug coverage pinches patients

By Sara HeathAs payers limit prescription drug coverage, they are increasingly setting up restrictions like prior authorizations and step therapy.

-

12 May 2025

Virgin Media O2, Daisy Group merge to form B2B comms company

By Joe O’HalloranComms provider and IT services company unite to offer digital-first connectivity and managed services

-

12 May 2025

University will ‘pull the plug’ to test Nutanix disaster recovery

By Antony AdsheadUniversity of Reading set to save circa £500,000 and deploy Nutanix NC2 hybrid cloud that will allow failover from main datacentre

-

09 May 2025

News brief: AI security risks highlighted at RSAC 2025

By Sharon SheaCheck out the latest security news from the Informa TechTarget team.

-

09 May 2025

ServiceNow shops share AI copilot results, prep for agents

By Beth PariseauIT ops teams have often already laid the groundwork for generative AI automation with platform consolidation and the previous wave of AIOps tools.

-

09 May 2025

UK broadband hits 2025 target with strong first quarter

By Joe O’HalloranStudy from UK communications regulator finds gigabit broadband on track to become virtually universally available across country by 2023, with the number of full-fibre broadband connections in particular increasing to nine million in past six months

-

09 May 2025

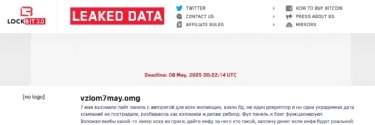

Ransomware: What the LockBit 3.0 data leak reveals

By Valéry Rieß-MarchiveAn administration interface instance for the ransomware franchise's affiliates was attacked on 29 April. Data from its SQL database has been extracted and disclosed

-

09 May 2025

Nutanix platform may benefit from VMware customer unrest

By Tim McCarthyNutanix's Next 2025 conference attendees are jumping ship to the platform after Broadcom's VMware buy, as Nutanix executives plan enterprise-driven evolutions for the platform.

-

09 May 2025

Datadog acquisition gives it feature flagging for AI

By Esther ShittuThe move enables the vendor to integrate the startup's feature flagging software into its products. It is the second acquisition the vendor has made in the past few weeks.

-

09 May 2025

Interview: Amanda Stent, head of AI strategy and research, Bloomberg

By Karl FlindersHallucinating AI, which lies through its teeth, keeps Amanda Stent busy at data analytics and intelligence giant Bloomberg

-

09 May 2025

Broadcom letters demonstrate push to VMware subscriptions

By Cliff SaranThe owner of VMware is reminding customers on perpetual licences that they will longer be able to buy support for their VMware products

-

09 May 2025

Channel catch-up: News in brief

By Simon QuickeDevelopments this week at Assured Data Protection, Acer, Canon, UiPath and Coro

-

09 May 2025

Government calls on tech companies to join crime-cutting campaign

By Lis EvenstadThe justice secretary met with 30 tech companies to discuss how technology can help to tackle prison violence and reduce reoffending rates

-

09 May 2025

Apple to play modest role after datacentre heat breakthrough in Denmark

By Mark BallardCountry at forefront of industrial heat recycling expects datacentres will take only modest role in heating homes after government paved way with widely celebrated law

-

09 May 2025

AvePoint highlights partner contribution to Q1 performance

By Simon QuickeSecurity player AvePoint is on a mission to grow revenue significantly over the next five years, with the channel a vital part of that ambition

-

09 May 2025

Government launches £8.2m plan to encourage girls into AI

By Clare McDonaldThe government is investing in teacher training and student support to get more girls into maths classes, ultimately leading to AI careers

-

09 May 2025

AI training gap puts Europe at a disadvantage

By Cliff SaranForrester study finds that workers in the US are more likely than their European counterparts to have received AI training to support their job roles

-

09 May 2025

Nordic countries plan offline payment system for disaster backup

By Karl FlindersBoard member of the Bank of Finland reveals plan as likelihood of losing internet connectivity increases amid geopolitical tensions

-

08 May 2025

Government will miss cyber resiliency targets, MPs warn

By Alex ScroxtonA Public Accounts Committee report on government cyber resilience finds that the Cabinet Office has been working hard to improve, but is likely to miss targets and needs a fundamentally different approach

-

08 May 2025

Nutanix CEO talks customer challenges and platform updates

By Tim McCarthyMany customers are still looking for a VMware exit and need a modernized platform, Nutanix President and CEO Rajiv Ramaswami says in this Q&A with Informa TechTarget.

-

08 May 2025

Preparing for post-quantum computing will be more difficult than the millennium bug

By Bill GoodwinThe job of getting the UK ready for post-quantum computing will be at least as difficult as the Y2K problem, says National Cyber Security Centre CTO Ollie Whitehouse

-

08 May 2025

Trump targets AI diffusion rule as big tech talks AI race

By Makenzie HollandPresident Donald Trump will walk back a Biden-era rule restricting the sale of advanced U.S. AI chips and models in the month it's set to take effect.